A new report from the institutional division of crypto exchange Coinbase, prepared in partnership with crypto intelligence firm Glassnode, reveals that despite a period of consolidation in the second quarter of 2024, the cryptocurrency market remains robust and continues to grow.

The second quarter reflected price consolidation, during which the prices of major assets remained in a relatively tight price window, the report said. Contrasted with the first quarter’s meteoric rise, this suggests market indecision. Even so, the broader market indicators suggest sustained health and potential for future growth.

“The price correction in the second quarter is both healthy and a natural part of the current market cycle,” the report notes.

This view is supported by strong trading volumes across spot and derivatives markets, continued inflows of new investors, and notable progress on the regulatory front.

“Looking beyond simple price movements reveals a very healthy crypto landscape,” the report adds.

The report also sheds light on the rising on-chain activity, particularly on the Ethereum network and its layer-2 solutions.

Average daily active addresses across Ethereum and leading layer-2s have surged by 127% this year, the report said, driven by increased activity on these scalable solutions. The transaction tally across the Ethereum ecosystem grew 59% in Q2, though most of that growth came from layer-2 scaling networks.

This surge in activity highlights the expanding use cases for Ethereum, from decentralized finance (DeFi) to NFTs and beyond. The diversification of investor interest and the growth in on-chain activity are promising signs of a healthy market.

“We are still in the mid-growth cycle as attention remains well diversified across the space,” Duong says.

A crucial aspect of understanding the market’s health is monitoring the market value to realized value (MVRV) ratio. The MVRV ratio helps gauge market sentiment by comparing the market value to the realized value.

“Periods where MVRV trades above its 365-day average are typically aligned with robust uptrends,” explains James Check, lead analyst at Glassnode.

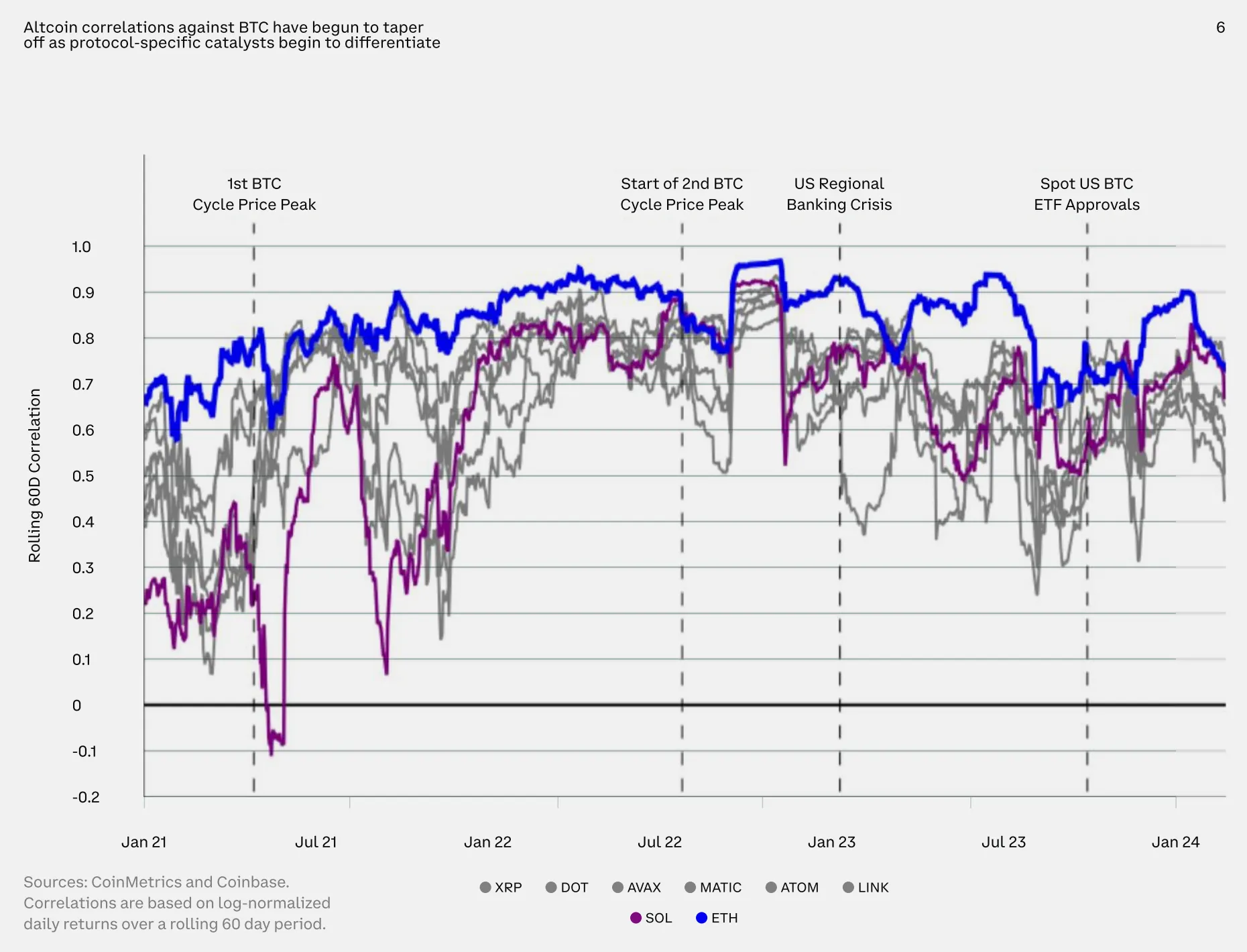

This metric is essential for identifying whether the market is overheated or undervalued, offering insights into investor profitability and potential market corrections. One of the report’s key highlights is the decline in correlations among crypto assets during the second quarter. The trend suggests that the crypto market is maturing, the report observes.

According to David Duong, head of institutional research at Coinbase, “This decoupling strengthens the case for owning crypto as a means of diversifying one’s portfolio in a systematic way.”

Edited by Ryan Ozawa

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.

Be the first to comment